The Facts About Pkf Advisory Services Uncovered

The Facts About Pkf Advisory Services Uncovered

Blog Article

What Does Pkf Advisory Services Mean?

Table of ContentsExcitement About Pkf Advisory ServicesPkf Advisory Services Fundamentals ExplainedGet This Report on Pkf Advisory ServicesPkf Advisory Services Things To Know Before You Get ThisThe 2-Minute Rule for Pkf Advisory Services

If you're looking for additional information beyond what you can locate on the internet, it's easy to get started with an in-depth, personalized monetary plan that you can evaluate without price or dedication. Take pleasure in the recurring support of a specialized expert in your corner.The overall expense you are anticipated to pay, consisting of the net advisory fee and the underlying fund charges and expenses, is approximately 1.00% of possessions under management. For additional information on costs and expenses of the service, please review the Costs and Settlement section of the. The T. Rowe Cost Retired Life Advisory Service is a nondiscretionary economic preparation and retirement income preparation service and a discretionary managed account program supplied by T.

Broker agent makes up the Retirement Advisory Solution are supplied by T. Rowe Rate Financial Investment Providers, Inc., participant FINRA/SIPC, and are carried by Pershing LLC, a BNY Mellon business, participant NYSE/FINRA/SIPC, which works as a cleaning broker for T. Rowe Rate Investment Providers, Inc. T. Rowe Price Advisory Solutions, Inc. and T.

Not known Factual Statements About Pkf Advisory Services

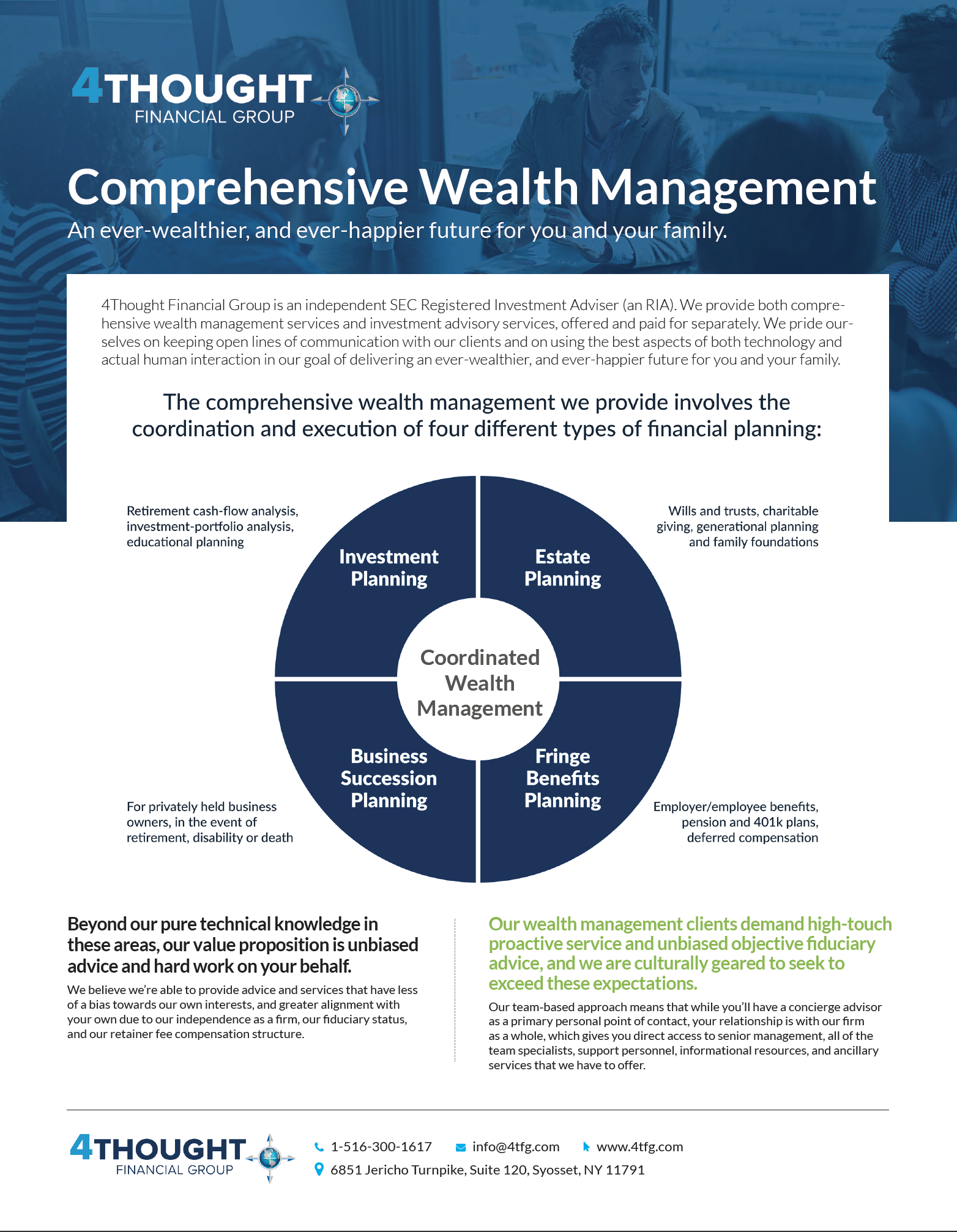

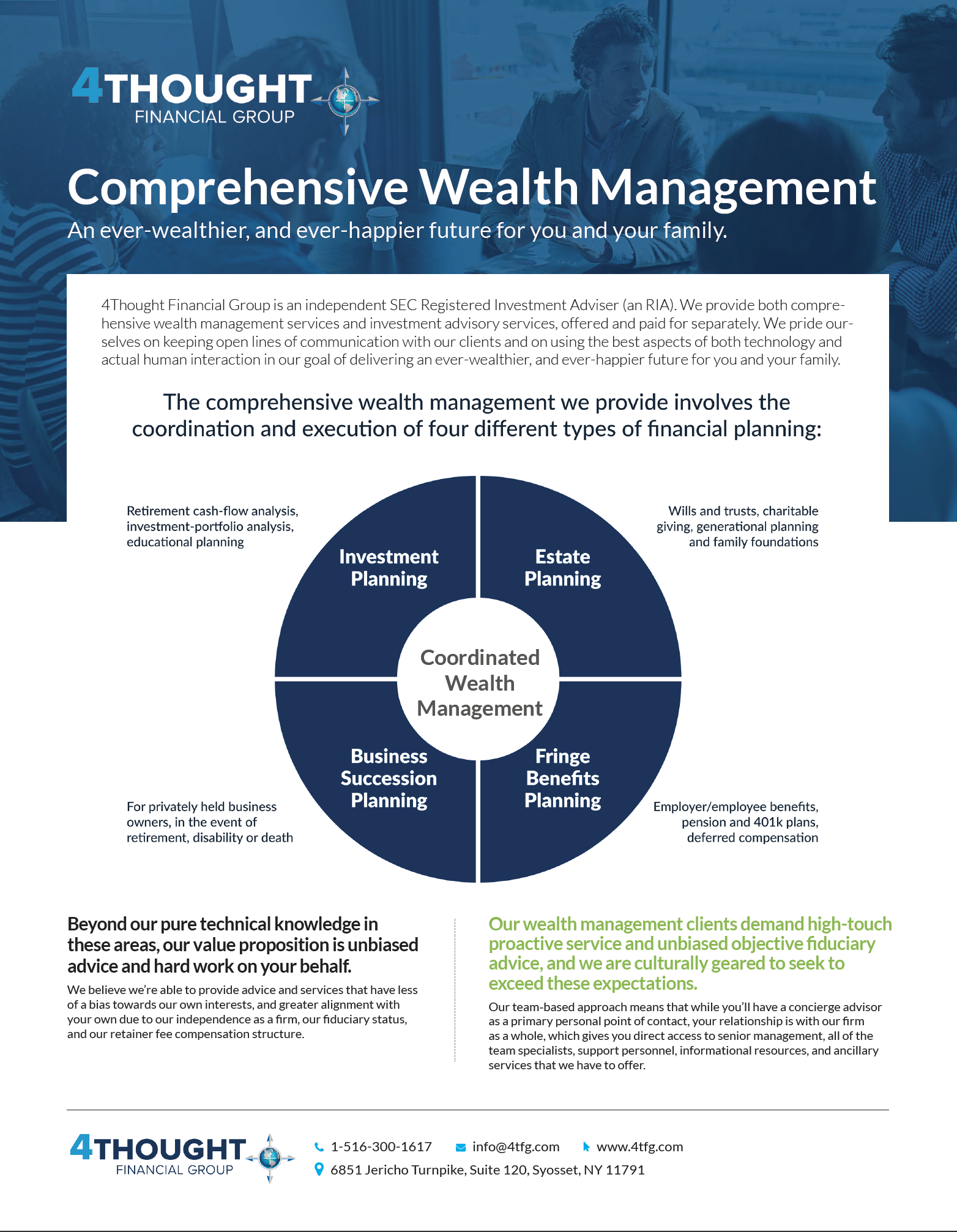

Providing recommendations is a critical component of IFC's method to create markets and activate personal financial investment. With this job, we aid develop the necessary problems that will certainly bring in the most private resources, allowing the personal industry to expand. IFC is changing to an extra critical method, systematically connecting our advisory programs to the best requirements identified in Globe Financial institution Group country and industry approaches.

Financial recommendations can be useful at turning factors in your life. Like when you're starting a household, being retrenched, intending for retired life or handling an inheritance.

The Single Strategy To Use For Pkf Advisory Services

When you have actually agreed to go ahead, your financial advisor will certainly prepare a monetary strategy for you. You ought to constantly really feel comfy with your consultant and their guidance. PKF Advisory Services.

Prior to you buy an MDA, contrast the advantages to the expenses and threats. To protect your cash: Do not provide your consultant power of lawyer. Never authorize an empty record. Put a time limitation on any kind of authority you offer to deal financial investments in your place. Firmly insist all document about your investments are sent to you, not simply your consultant.

This might occur during the conference or digitally. When you get more get in or restore the recurring cost setup with your adviser, they must explain just how to finish your connection with them. If you're relocating to a brand-new advisor, you'll require to set up to transfer your monetary documents to them. If you need help, ask your advisor to clarify the procedure.

Not known Facts About Pkf Advisory Services

Many assets come with obligations attached. The general procedure aids develop possessions that do not become a concern in the future.

Like your best auto person, economic consultants have years of training and experience behind them. They have a deep understanding of economic products, market motion, and take the chance of administration so you can trust that the choices that make up your monetary plan are made with self-confidence.

The 10-Second Trick For Pkf Advisory Services

This is what you can use to try the sushi put the road or see your favorite band at Red Rocks. PKF Advisory Services. When it comes to taxes, a great monetary consultant will informative post make sure that you're only paying the minimum amount you're required to pay, aiding you placed several of your hard-earned cash back in your pocket

The potential value of monetary suggestions depends on your webpage economic situation. You need assistance establishing financial goals for your future You're not sure how to invest your cash You're in the center of (or preparing for) a major life event You need responsibility or an unbiased second point of view You simply don't like dealing with cash To identify if functioning with a monetary advisor is best for you and make sure a successful relationship, the best thing to do is ask excellent concerns up front.

Here are a couple of examples of questions you can ask a monetary expert in the initial conference. A financial consultant who is a fiduciary is called for by legislation to act in your ideal passion.

Report this page